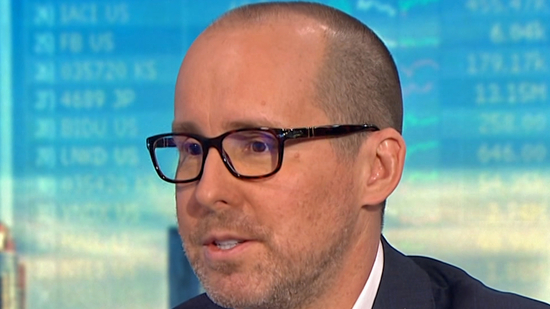

Mark Spitznagel, chairman and chief investment officer at Universa Investments, has said the recent stock market decline could be a precursor to a larger decline. He calls this decline a “trap,” meaning it is not the event but a precursor to something bigger. Spitznagel foresees a eventual 80% market crash, noting that the current situation is inconvenient but that the biggest impact is coming.

Universa Investments is recognized for its “Black Swan” strategy, which aims to take advantage of unusual and unforeseen occurrences. This strategy came into the limelight when the fund made a big profit during the market pandemonium caused by the COVID-19 pandemic in 2020.

Fortune

Spitznagel warns investors to watch for the big three economic indicators, which are slowing economic growth, receding inflation, and falling U.S. bond yields. He is short-term bullish, and he believes that a delayed recession will produce more market gains before any serious decline.

AInvest

These are warnings during a time of extreme volatility in international financial markets, which makes investors think about risk management measures in preparation for possible future interruptions.